memorandum of transfer malaysia

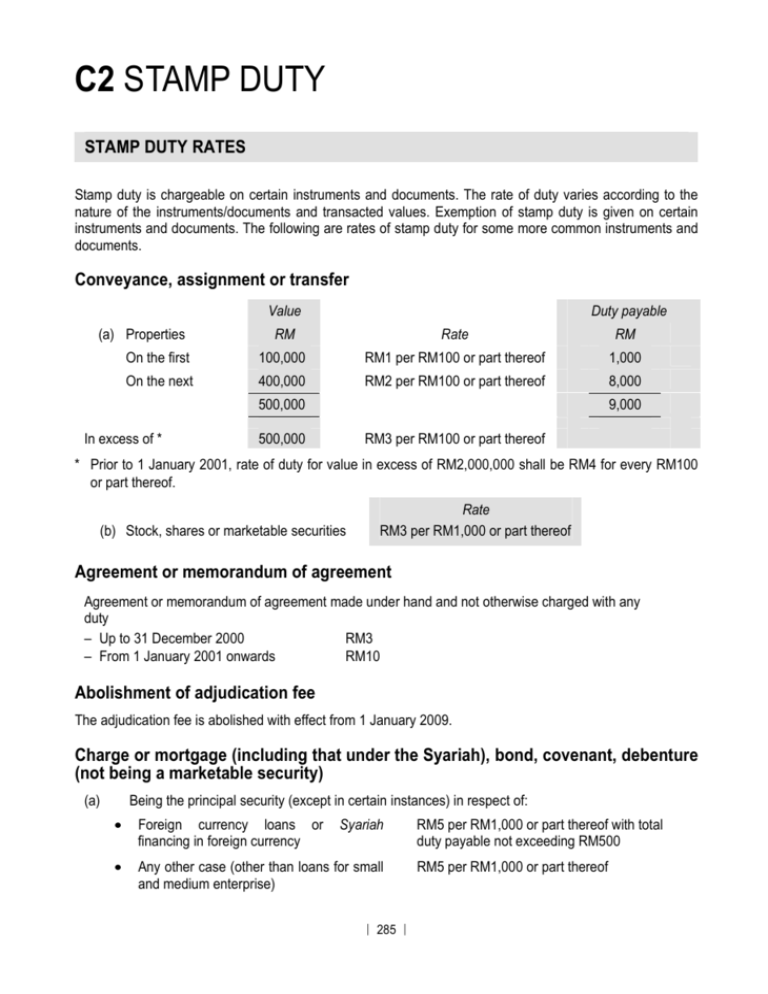

If buying a new home is on your mind this year it is critical to understand the property stamp duty and how you can get a stamp duty exemption especially for a first-time house buyer Stamp Duty To Purchase A Property PROPERTY PRICE RATES For the first RM100000 10 From RM100001 to RM500000. 19042021 19042021 MyLegalWeb PROPERTY LAW.

What Is Memorandum Of Transfer How Does It Work In Malaysia Blog

For property price exceeding RM75 million legal fees of the excess RM75 million is negotiable but subjected to maximum.

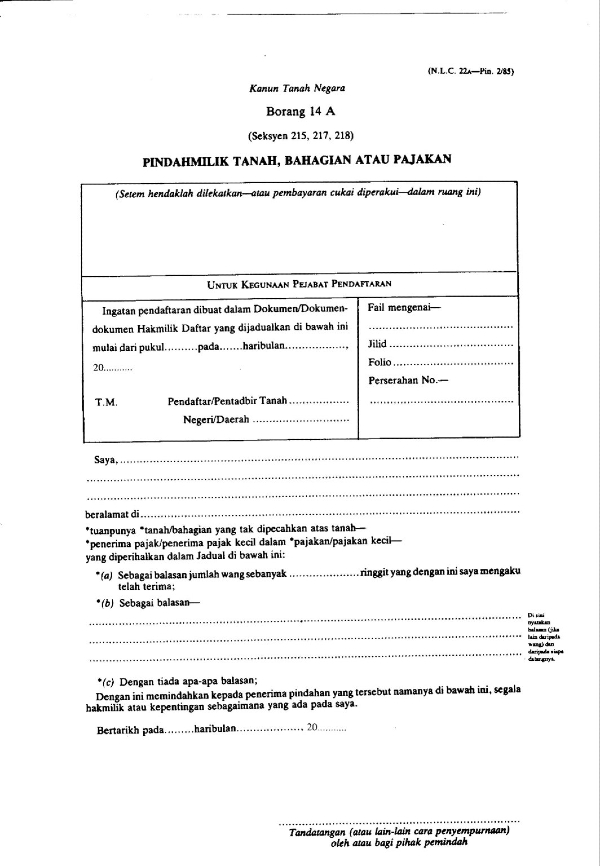

. Memorandum of transfer malaysia Sunday May 29 2022 Edit. Form 14A Transfer of Ownership is signed by the developer. The assessment and collection of stamp duties is governed by the Stamp Act 1949.

In Malaysia its known as Borang 14A and it looks like this. It is basically a document that indicates the property is yours and its used to transfer ownership of the house from the developer to you or in the case of secondary market purchases transfer ownership of the house from the seller to you. Prepare one 1 original copy and two 2 duplicate copies of the MOT.

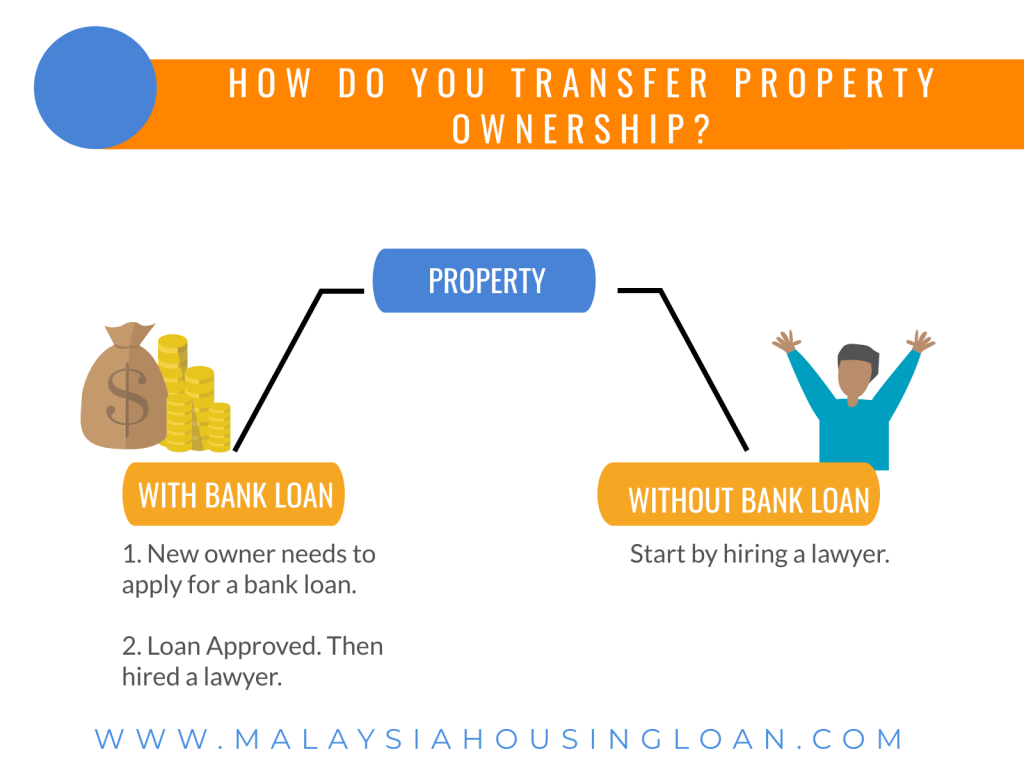

The calculations done by this calculator is an estimation of Stamp Duty on MOT of house purchase in Malaysia it gives you an idea how much money you. In Malaysia a Memorandum of Transfer MOT is a document that the buyer signs to transfer ownership from the seller to the buyer. In addition a document called Developer Consent must be obtained with the deed of assignment.

You can choose whether you want to transfer the entirety 50 of the property or any amount. Image from Urusan Tanah Perak via Blogspot. Both quotations will have slightly different in terms of calculation.

The Memorandum of Transfer is prescribed under the NLC 1965 to affect the registration of transfer of ownership where title is available and it will be prepared by the purchasers lawyer. Hence its not issued if the property in question doesnt have its Land Title yet. Credit Transfer in Malaysia.

Memorandum of Transfer MOT MOT is a legal document prescribed by the National Land Code 1965 which is used to effect the transfer of the ownership of the property once the individual title strata title is issued from the developer to the purchaser. Form 14A Transfer of Ownership is signed by the purchaser. This calculator calculates the estimated or approximate fees needed for Stamp duty on Memorandum of Transfer MOT.

Stamp duty for Memorandum of transfer in Malaysia MOT Malaysia can be extremely pricey and do check out the chart below for the tier rate. This is because our land law in the Peninsula of Malaysia is governed by the National Land Code 1965 where we use the Torrens Syst. Form 14A indicates who the owner is and who is the assignor the acquirer and the number of shares you wish to transfer.

Normally the two main cost of the transfer is the stamp duty and the legal fees shown below. The stamp duty is a revenue payable when an application is made to register changes to a certificate of title or ownership. The purchaser pays the legal fees stamp duty and disbursements accordingly.

Memorandum of Transfer Form 14A Memorandum of Transfer Form 14A is a form of registering the title into the purchasers name at the Land Office. Before presenting the Memorandum of Transfer MOT for registration purpose at the Land and Survey Department Sarawak we must ensure that we follow the required procedure. Property ownership in Malaysia ultimately requires the owners name to be registered on a document of title maintained by the respective land office or land registry.

In Malaysia a Memorandum of Transfer MOT is a document that the buyer signs to transfer ownership from the seller to the buyer. Signing the MOT means that the Land Title will be transferred from the developer or previous proprietors name to yours. Stamp duty is the amount of tax levied on your property documents such as the Sales and Purchase Agreements SPA the Memorandum of Transfer MOT and the loan agreement.

Basic Process of Perfection Of Transfer. You will get a full summary after clicking Calculate button. UPDATES ON STAMP DUTY MALAYSIA FOR YEAR 2022.

New Proposed Regulations For Cryptocurrencies In Malaysia. SPA Loan Agreement quotation includes Legal fees amount Disbursement Fees 6 SST and stamp duty. Preparation of complete MOT.

A Memorandum of Transfer also. There are two types of stamp duties which are ad valorem duty and fixed duty. Stamp duty is paid at LHDN.

To use the calculator key in the property price. You need to login to view this content. Hence its not issued if the property in question doesnt have its Land Title yet.

Memorandum of Transfer MOT MOT is a legal document prescribed by the National Land Code 1965 which is used to effect the transfer of the ownership of the property once the individual title strata title is issued from the developer to the purchaser. How stamp duty is calculated. Signing the MOT means that the Land Title will be transferred from the developer or previous proprietors name to yours.

The calculator will automatically calculate total legal or lawyer fees and stamp duty or Memorandum of Transfer MOT. In some cases when purchasing from a developer the MoT may not be issued at the time of purchase. The Memorandum of Transfer that we just mentioned is a form used to transfer ownership of property from one person to another.

On any amount in excess of RM100000 but not exceeding RM500000.

A Malaysian Guide To Home Buying Fees Charges Infographic Home Buying Home Buying Tips Infographic

What Is Memorandum Of Transfer How Does It Work In Malaysia Blog

Photos Airbus A319 115 Aircraft Pictures Airliners Net Airbus Aviation Aircraft Pictures

Your Simple Guide To Perfection Of Transfer And Perfection Of Charge

Letter Of Intent For The Collaboration Between Lincoln University Collage Malaysia And Maalmatera By Ma Al Mu Min Muhammadiyah Tembarak Issuu

What Is Memorandum Of Transfer How Does It Work In Malaysia Blog

How Do You Legally Transfer Property To Someone Else In Asklegal My

Memorandum Of Transfer Mot And 4 Important Documents In Malaysia

7 Common Questions On Property Title Transfer Issues Answered

Memorandum Of Transfer Malaysia 2022 Malaysia Housing Loan

How Do You Legally Transfer Property To Someone Else In Asklegal My

C2 Stamp Duty The Malaysian Institute Of Certified Public

Your Simple Guide To Perfection Of Transfer And Perfection Of Charge

Faqs Perfection Of Transfer And Charge Publication By Hhq Law Firm In Kl Malaysia

Why Are Legal Documents And Memorandum Of Transfer Mot Important Propertyguru Malaysia Memorandum Legal Documents Documents

Free Rent To Own Form Printable Pdf Contract Template Lease Agreement Free Printable Rental Agreement Templates

Memorandum Of Transfer Mot And 4 Important Documents In Malaysia

Why Are Legal Documents And Memorandum Of Transfer Mot Important Propertyguru Malaysia Memorandum Legal Documents Documents

Memorandum Of Transfer Mot And 4 Important Documents In Malaysia